REAL ECONOMY BLOG | July 26, 2022

Authored by RSM US LLP

Central banks in developed economies are contending with a series of shocks that have threatened price stability and, ultimately, economic growth.

Now, these shocks, which include inflation, interest rate increases and energy market turmoil, are all showing up in fixed income markets.

With consumer inflation at 9.1%—its highest level since the 1970s and 1980s, when energy shortages resulted in similar crises of instability—the Federal Reserve is engaged in a campaign to restore price stability in such a way that risks causing a recession.

A rising overnight rate…

The Federal Reserve has already pushed the cost of short-term borrowing from zero to 1.75% and is expected to hike rates by at least another 1.5 percentage points over the next six months. At this point, it is difficult to make the case that the Fed will not push its policy rate to at least 4% next year before it decides to stop and focus on the maximum sustainable employment portion of its dual mandate.

…will push up long-term rates…

The increase in the overnight rate will pressure longer-term Treasury bonds and corporate bonds higher. For instance, the yield on two-year Treasury bonds is considered to be the present value of the path of the overnight rate two years out. Bonds for longer maturities—like 10-year bonds, which are linked to economic growth—tend to have their yields increase as the overnight rate rises.

…as the Fed unwinds its balance sheet

Another factor pushing interest rates higher will be the end of Federal Reserve purchases of Treasury bonds and mortgage-backed securities, and the gradual drawdown of its holdings. The increased supply of bonds on the market should increase bond yields.

Investors will seek safety…

There will also be factors out of the Fed’s control that will push yields lower. As uncertainty over the global economy increases, we can anticipate the demand for the safety of U.S. securities to increase. Interest rates in Europe and Japan remain closer to zero and the dollar continues to rise, all of which increases the attractiveness of dollar-denominated securities.

…as financial conditions tighten

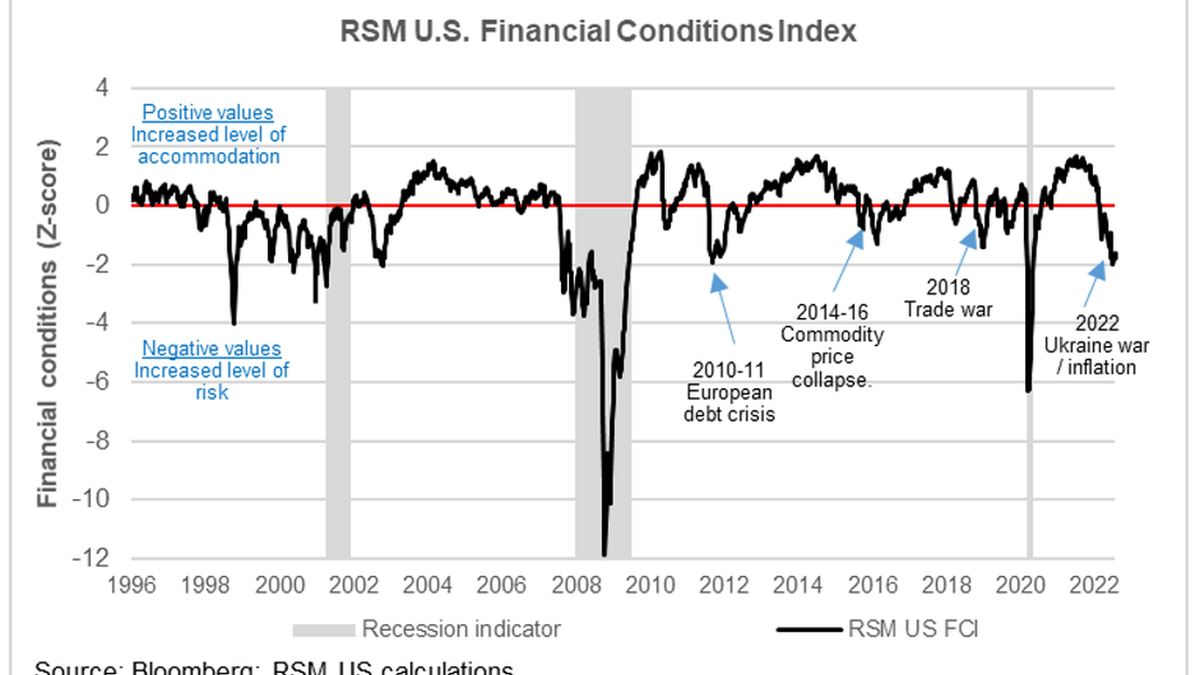

The elephant in the room, however, is the effect of Fed tightening on financial conditions and economic growth. Financial conditions—as measured by the RSM US Financial Conditions Index—are significantly below normal levels of risk priced into financial assets. That implies a decreased level of economic growth in coming quarters.

The yield curves tell the story…

The difference between long-term (10-year) bond yields and short-term (three-month) money market rates has generally followed the progression of the business cycle. Because short-term money market rates respond quickly to federal funds rate settings, you would expect the spread between long-term rates and short-term rates to be the widest immediately after a recession. That spread would tend to narrow as short-term rates move higher during the recovery.

…of the Fed’s bind

When short-term rates are pushed higher as the economy overheats, you would expect the spread to narrow and turn negative as concerns grow over the health of the economy, driving bond yields lower.

The spread between 10-year bond yields and three-month Treasury bills is a mere 26 basis points, which gives credence to the notion that the Fed has no choice but to raise short-term rates to increase the cost of borrowing and lending, driving economic growth lower.

The takeaway

Because two-year bond yields are a function of the path of the overnight federal funds rate over the course of the next two years, and because the Fed is pushing the federal funds rate higher, two-year bond yields have moved higher. And because the bond market is now more concerned about the prospect of a recession, 10-year yields have moved lower in recent trading.

Though not a consistent precursor of recessions, the negative 10-year/two-year spread is nonetheless disconcerting.

This article was written by Joseph Brusuelas and originally appeared on 2022-07-26.

2022 RSM US LLP. All rights reserved.

https://realeconomy.rsmus.com/monetary-policy-tightening-the-bond-market-and-the-business-cycle/

RSM US Alliance provides its members with access to resources of RSM US LLP. RSM US Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each is separate and independent from RSM US LLP. RSM US LLP is the U.S. member firm of RSM International, a global network of independent audit, tax, and consulting firms. Members of RSM US Alliance have access to RSM International resources through RSM US LLP but are not member firms of RSM International. Visit rsmus.com/about us for more information regarding RSM US LLP and RSM International. The RSM logo is used under license by RSM US LLP. RSM US Alliance products and services are proprietary to RSM US LLP.

Firley, Moran, Freer & Eassa is a proud member of RSM US Alliance, a premier affiliation of independent accounting and consulting firms in the United States. RSM US Alliance provides our firm with access to resources of RSM US LLP, the leading provider of audit, tax and consulting services focused on the middle market. RSM US LLP is a licensed CPA firm and the U.S. member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries.

Our membership in RSM US Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise, and technical resources.

For more information on how the Firley, Moran, Freer & Eassa can assist you, please call us at (315) 472-7045.