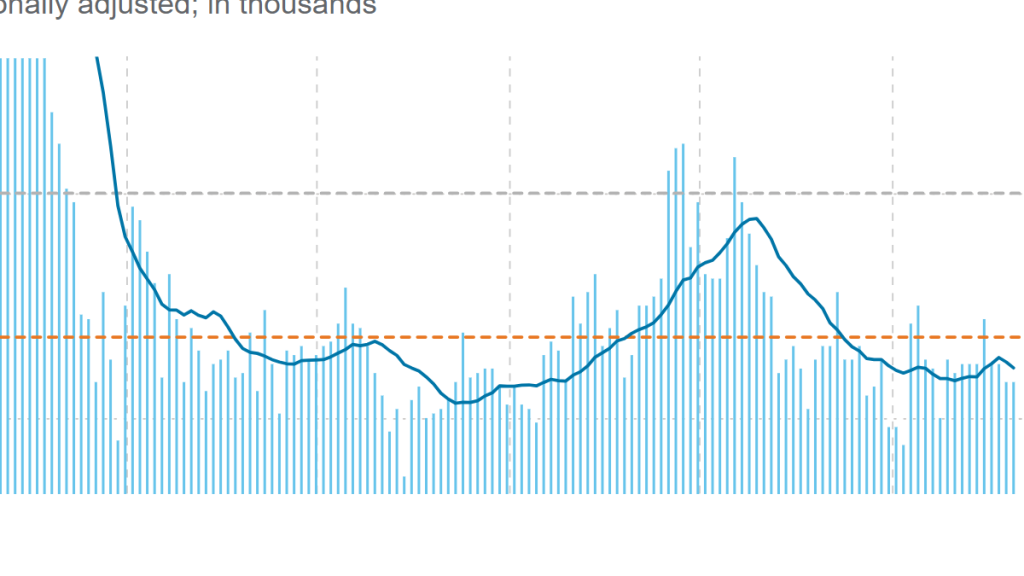

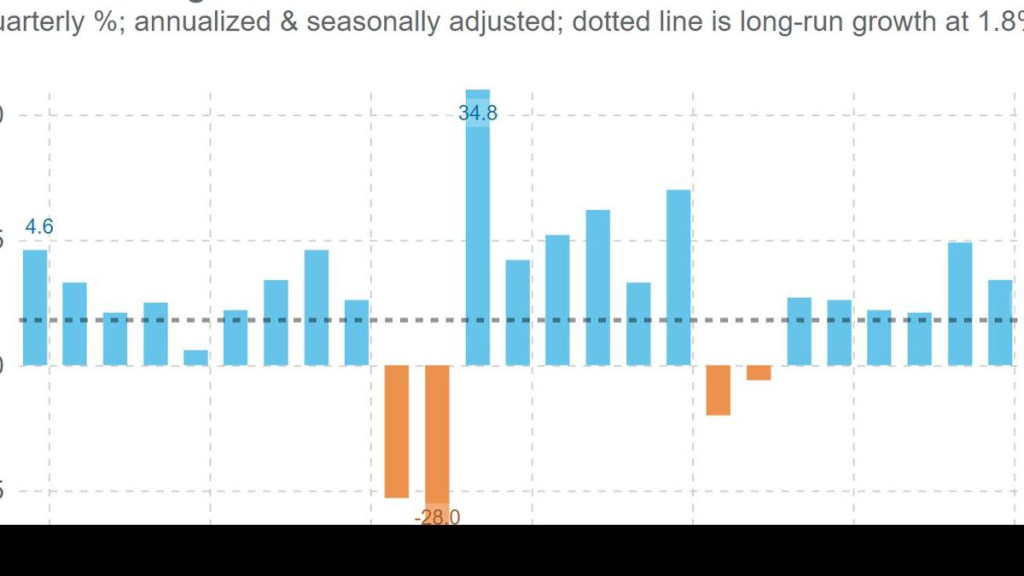

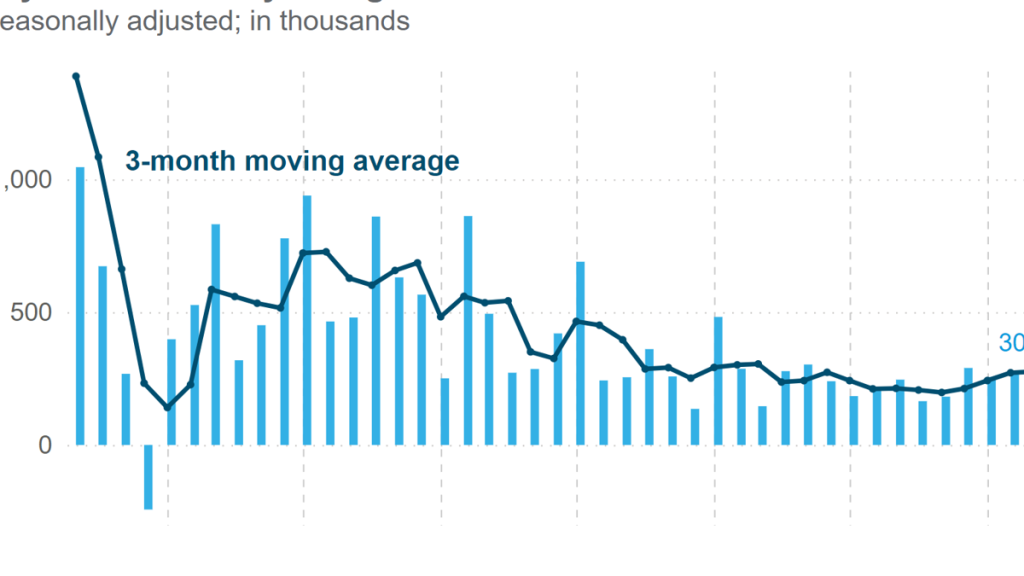

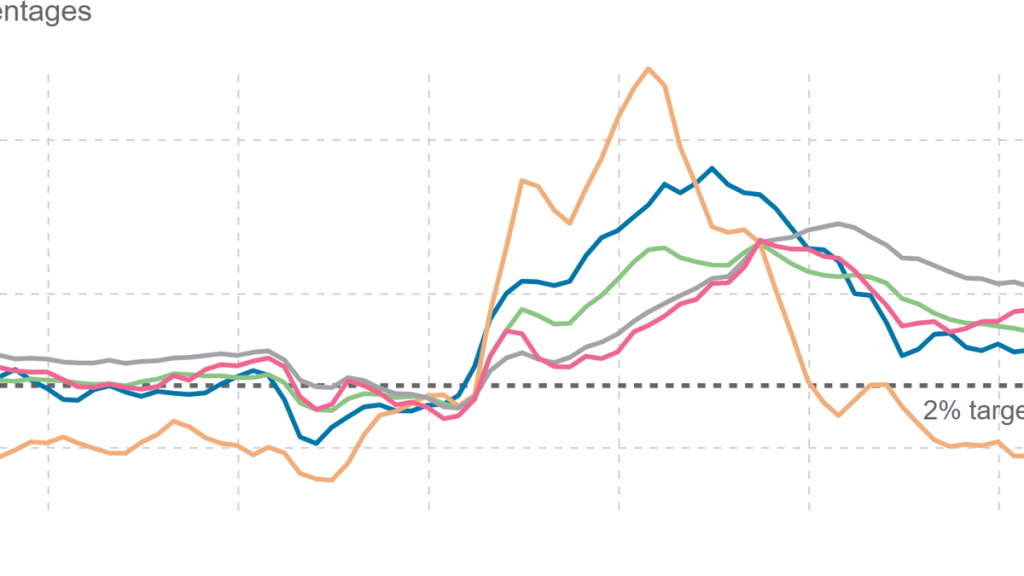

Labor data shows economic strength as inflation concerns linger

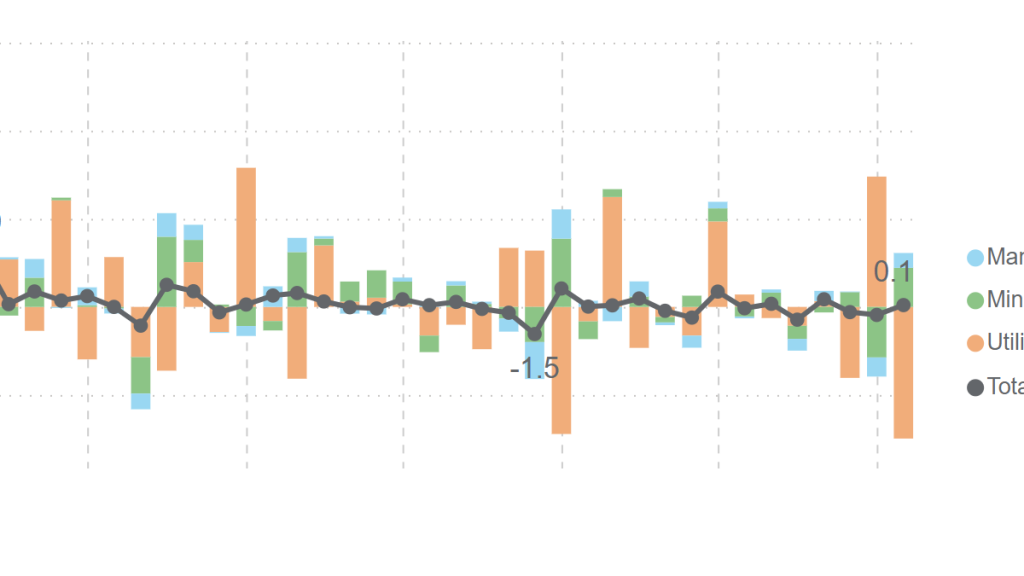

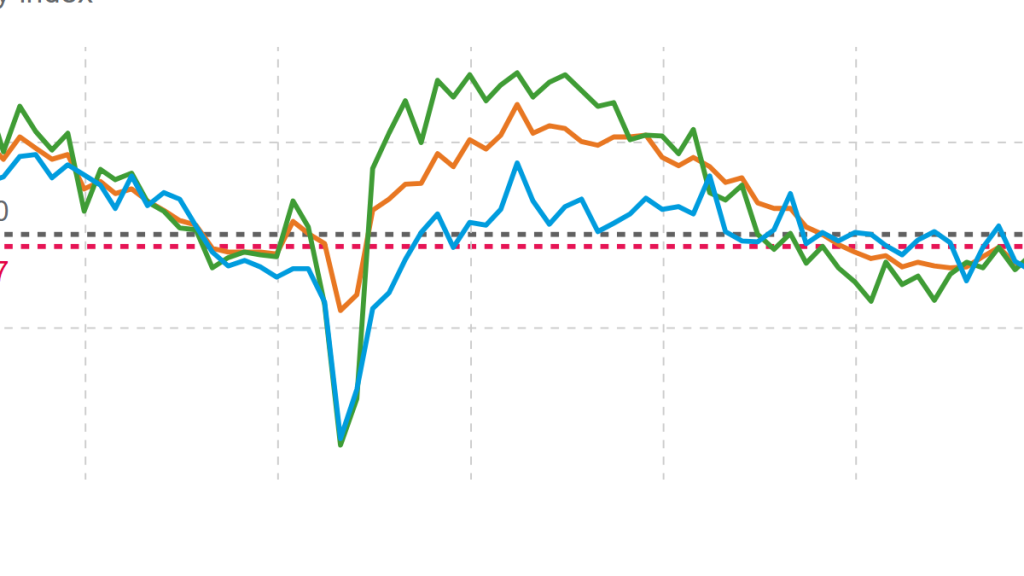

Despite a slowdown in productivity and rising labor unit costs, the economy continues to show strength with initial jobless claims staying near ...

The FMF&E team prides itself on ensuring that you have quick and easy access to top professionals for any challenge. Our unique model gives our clients confidence that our experienced team can be trusted with your most complex challenges.