Industry:

Service:

Topic:

- All

- Artificial Intelligence

- Blockchain

- CECL

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Analytics

- Digital Assets

- Economics

- Employee Benefit Plans

- Employee Benefits

- ESG

- Financial Reporting

- Inflation

- International Standards

- Labor and Workforce

- Lease Accounting

- PCAOB Matters

- Policy

- Revenue Recognition

- SEC Matters

- Supply Chain

IRS announces updated Reference Standard for section 179D

New standards affirmed for energy efficient commercial buildings deductions, but old standards apply for several more years.

New EU ‘Green Import Tariff’

EU Carbon Import Tariff & EU Carbon Import Tax.

Treasury and IRS release interim guidance on corporate minimum tax

Notice 2023-7 provides interim guidance on certain items related to the new corporate minimum tax in anticipation of forthcoming proposed regulations.

FASB Proposes Changes to Lease Accounting Rules

The Financial Accounting Standards Board recently issued a proposed Accounting Standards Update for Leases (Topic 842). The update addresses ...

Treasury issues guidance for clean vehicle manufacturers and sellers

For manufacturers and sellers of clean vehicles to claim new tax incentives, they must follow procedures recently outlined by the Treasury Department.

Proposed improvements to leases guidance on related party arrangements

Proposed improvements to leases guidance on related party arrangements

The Financial Accounting Standards Board (FASB) has issued a proposed ...

Schedules K-2 and K-3 draft instructions for tax year 2022

Pass-through entities and partners alike should understand the compliance changes associated with the IRS's recent release of updated draft ...

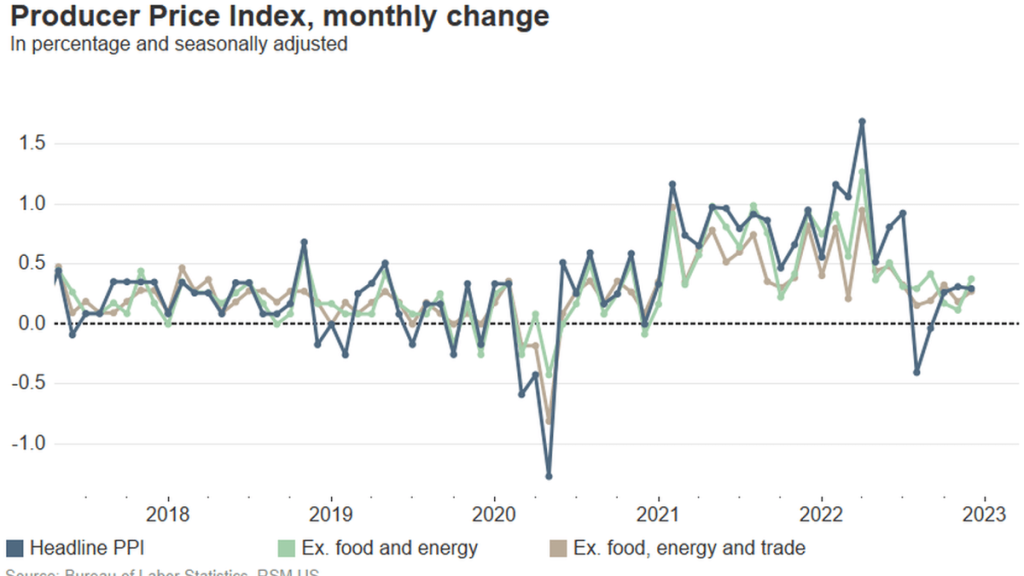

Producer price inflation hotter than expected ahead of Fed’s meeting

The producer price index for final demand rose by 0.3% in November and by 7.4% year-over-year, the Bureau of Labor Statistics reported on Friday.

Financial services organizations and edge computing

Financial services organizations need to assess what edge computing means for customers and growth plans.

Financial services organizations should monitor and refresh CECL models

Financial services organizations that are further along in their CECL journey should examine how their CECL model is already working.

How the new corporate AMT affects foreign-owned U.S. companies

Explaining how the new 15% corporate alternative minimum tax (AMT) in the Inflation Reduction Act of 2022 could significantly affect foreign-owned U.S.

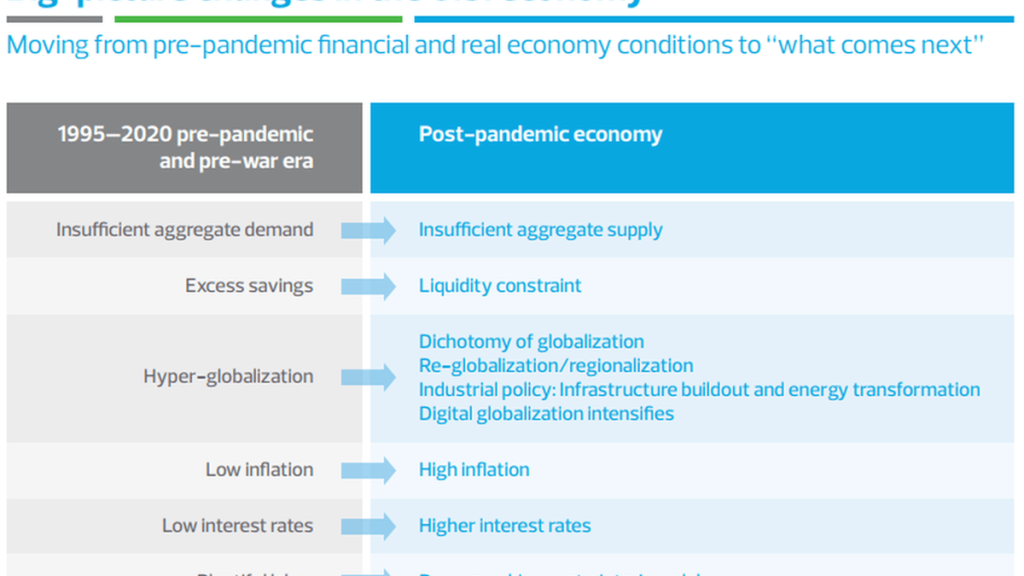

The post-pandemic era and the end of hyper-globalization

The American economy is in the midst of a long-lasting structural change following the severe shocks unleashed by the pandemic.

Treasury releases much anticipated proposed FTC regulations

Last Friday, Treasury released proposed foreign tax credit regulations aiming to clarify the cost recovery requirement and royalty withholding ...

New credit amounts for the Production Tax Credit for 2022

IRS announces new tax credit amounts under section 45 of the Internal Revenue Code, for the calendar year 2022.

Clean energy incentives for manufacturers

The Inflation Reduction Act of 2022 provides new and expanded clean energy incentives for businesses in the manufacturing sector

Top Professionals Ready To Serve You

The FMF&E team prides itself on ensuring that you have quick and easy access to top professionals for any challenge. Our unique model gives our clients confidence that our experienced team can be trusted with your most complex challenges.