Industry:

Service:

Topic:

- All

- Artificial Intelligence

- Blockchain

- CECL

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Analytics

- Digital Assets

- Economics

- Employee Benefit Plans

- Employee Benefits

- ESG

- Financial Reporting

- Inflation

- International Standards

- Labor and Workforce

- Lease Accounting

- PCAOB Matters

- Policy

- Revenue Recognition

- SEC Matters

- Supply Chain

IRS will use AI to help target partnerships and high net worth individuals

The IRS announced a sweeping enforcement effort that will engage AI to focus on large partnerships and wealthy individuals.

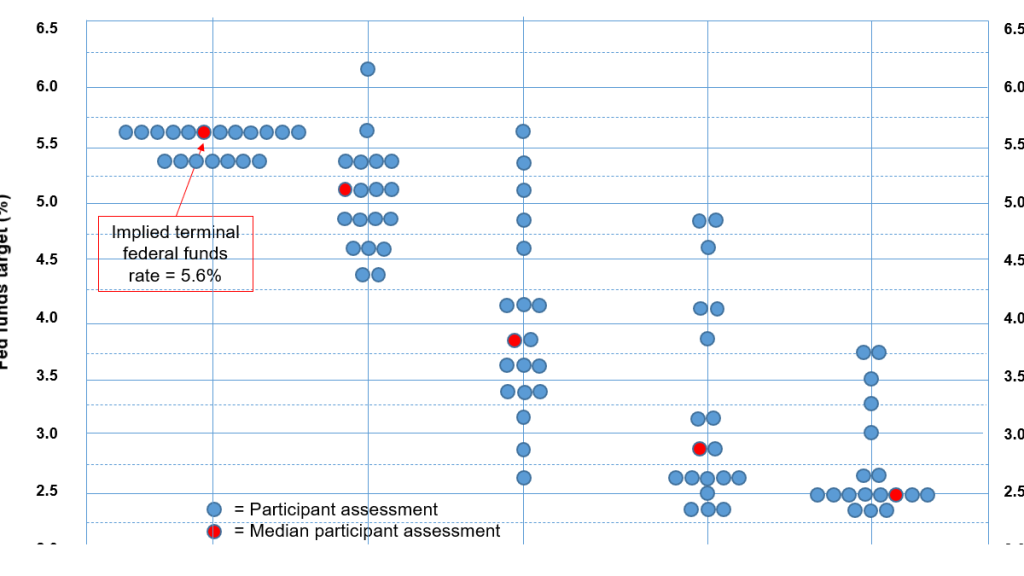

FOMC preview and the logic of Fed rate cuts in 2024

After nearly two years of raising the federal funds policy rate to restore price stability, the Federal Reserve is poised to all but declare ...

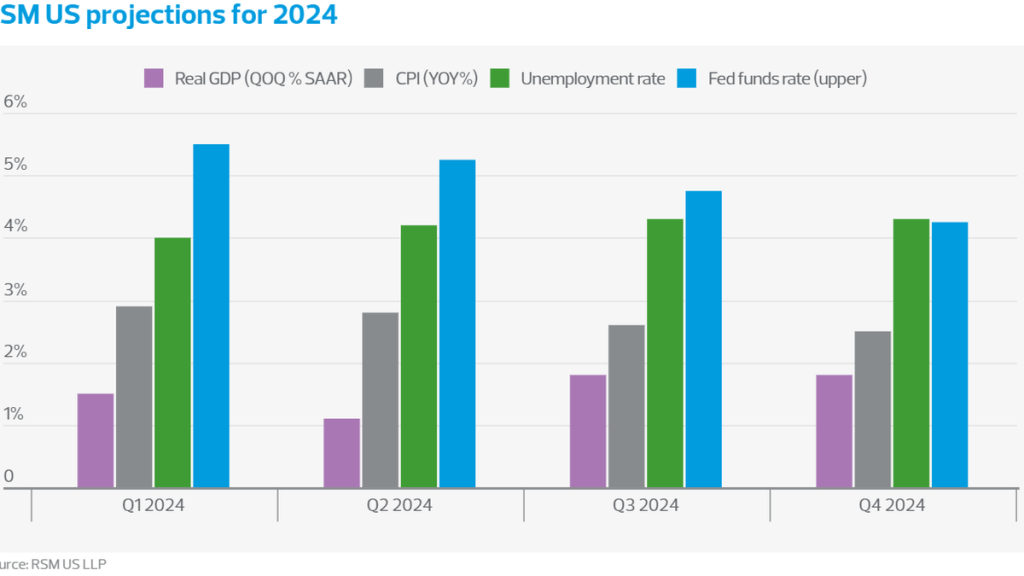

U.S. economic outlook: Expansion continues into 2024

Expect the economy to settle into its long-term growth rate of around 1.8% next year. Read our forecasts for growth, inflation, unemployment, ...

What To Do With Old Retirement Accounts

You likely have at least one old retirement account if you've ever changed employers. These accounts stay exactly as you left them unless you ...

The 1031 Exchange Explained

In the world of real estate, the Section 1031 exchange has been a significant tool for investors who want to grow their real estate portfolio ...

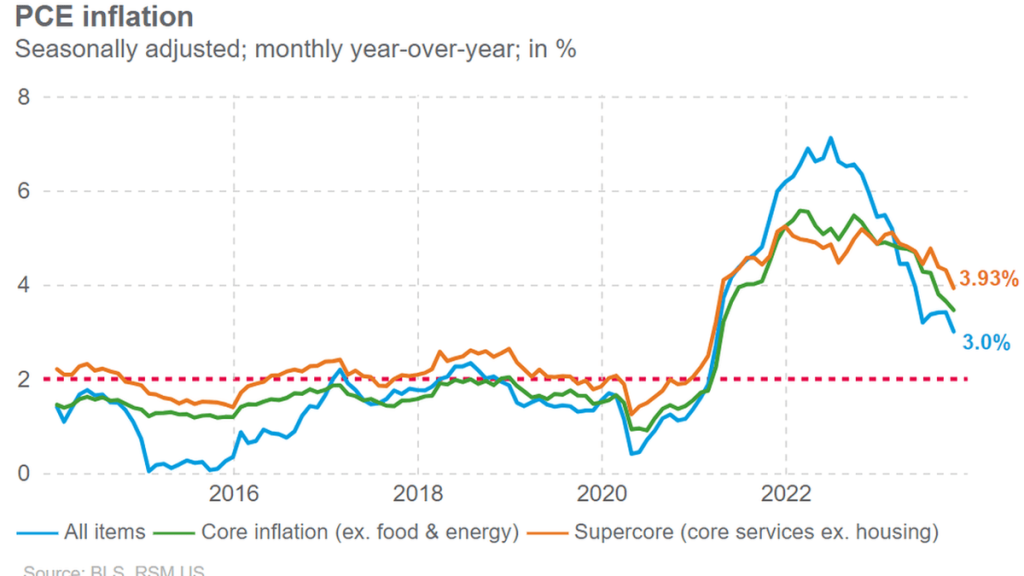

Inflation slows again, pointing to another rate pause

The personal consumption expenditures price index, the Federal Reserve's favorite inflation metric, was unchanged on the month, while the core ...

IRS delays implementation of lower $600 reporting threshold for 1099-K

New IRS notice 1099-K for small vendors will be subject to existing requirements for TY 2023, followed by a phased-in approach.

New IRA energy credit guidance

New ITC regulations address tax credit for solar, energy storage, geothermal, biogas, CHP and microgrid controller property

IRS issues guidance on the transfer of clean vehicle credits

The IRS and the Treasury Department have released guidance on how buyers can transfer clean vehicle credits to dealers at the time of purchase.

IRS Releases 2024 tax inflation adjustments

IRS releases inflation adjustments for 2024. Inflation adjustments impact individual tax brackets and other various provisions of the Code.

IRS clarifies government orders for ERC claims

OSHA communications are not government orders that support ERC eligibility in most cases says GLAM 2023-007.

Two Estate Planning Strategies to Help Protect Wealth

A goal of estate planning is to maximize the wealth that is passed on to one's heirs. In this video, we'll discuss how a Spousal Lifetime Access ...

IRS releases 2024 retirement plan limitations

Cost-of-living adjustments to retirement plan limits for 2024 have been issued by the IRS in Notice 2023-75.

The Key Functions of Your Nonprofit Board

Nonprofit board service can be as exhausting as it is rewarding. Whether you are on a board yourself, thinking about joining a board, or seeking ...

Major regulatory change on the horizon for financial institutions

Major regulatory change is on the horizon for financial institutions, including new liquidity and capital requirement rules.

Top Professionals Ready To Serve You

The FMF&E team prides itself on ensuring that you have quick and easy access to top professionals for any challenge. Our unique model gives our clients confidence that our experienced team can be trusted with your most complex challenges.